- Home

- »

- Biotechnology

- »

-

Protein Chip Market Size, Share And Growth Report, 2030GVR Report cover

![Protein Chip Market Size, Share & Trends Report]()

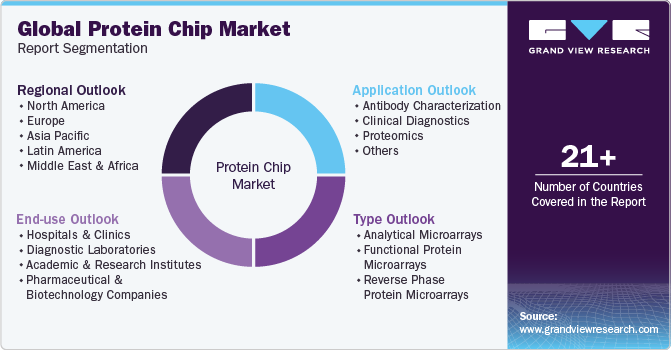

Protein Chip Market Size, Share & Trends Analysis Report By Type (Analytical Microarrays, Reverse Phase Protein Microarrays), By Application (Antibody Characterization, Clinical Diagnostics), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-260-0

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Protein Chip Market Size & Trends

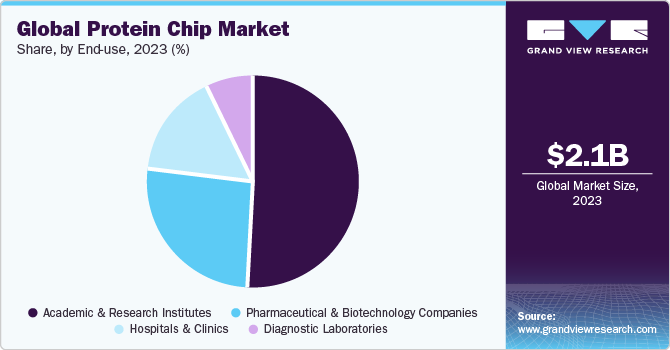

The global protein chip market size was estimated at USD 2.12 billion in 2023 and is projected to grow at a CAGR of 6.88% from 2024 to 2030. The market growth is significant in recent years, owing to the growing prevalence of chronic diseases such as cancer, cardiovascular diseases, and neurological disorders, increasing diagnostic applications, and ongoing technological advancements. Furthermore, the growing investment for proteomics research & technology development is anticipated to fuel the market growth over the forecast period.

The COVID-19 pandemic has positively impacted the global market, owing to various factors such asincreasing focus on disease research, growing demand for high-throughput screening, and advancements in diagnostics. The urgent need for rapid and high-throughput screening methods to identify potential drug candidates and study virus-host interactions has driven the demand for protein chips. Protein chips enable researchers to simultaneously analyze multiple proteins, accelerating the drug discovery process. Moreover, the pandemic has increased awareness of the importance of disease research and diagnostics. Protein chips offer a valuable tool for studying protein interactions, identifying biomarkers, and developing diagnostic assays for COVID-19 and other infectious diseases.

Advancements in proteomics research have significantly influenced the market by driving innovation and expanding the capabilities of protein chip technologies. Proteomics techniques have evolved to enable the comprehensive analysis of protein expression, structure, interactions, and functions in complex biological systems. These advancements have led to the development of protein chips with improved sensitivity, throughput, and multiplexing capabilities, allowing researchers to simultaneously analyze proteins in a high-throughput manner. For instance, in February 2024 , Researchers from the Institute of Cancer Research (ICR) have discovered a novel method for examining proteins involved in breast cancer progression. Led by the ICR’s Molecular Endocrinology Group in partnership with the institute’s Functional Proteomics Research Group, scientists employed an advanced technique to identify most of the proteins interacting with estrogen receptor alpha (ERα).

Moreover, protein chips have emerged as powerful tools in diagnostic applications, revolutionizing disease biomarker discovery, diagnosis, prognosis, and treatment monitoring. Their unique ability to analyze multiple proteins simultaneously enables comprehensive profiling of protein expression patterns, facilitating the identification of disease-specific biomarkers.

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. These may include increasing adoption of protein chip technology across various industries, rising demand for personalized medicine and precision diagnostics, advancements in proteomics research, and expanding applications in drug discovery and biomarker identification. In addition, collaborations, technological innovations, and favorable regulatory landscapes contribute to the accelerated growth trajectory.

In the global market, partnerships and collaboration activities are moderately prevalent, reflecting a medium level of engagement within the industry. Companies often collaborate with academic institutions, research organizations, and other industry players to leverage complementary expertise, resources, and technologies. These collaborations facilitate technology development, validation, and commercialization, leading to the introduction of innovative products and services in the market. For instance, February 2022, MRM Proteomics, Inc. (MRMP) and Agilent Technologies Inc. announced a new co-marketing agreement. This partnership aims to enhance the capabilities of quantitative proteomic applications, facilitating significant scientific discoveries within the research community .

Regulatory impact in the market is significant, encompassing product approval, quality assurance, labelling requirements, post-market surveillance, and international harmonization efforts. Adherence to strict manufacturing standards, accurate labelling, and reporting of adverse events ensure product reliability and user safety.

The market currently exhibits a moderate level of product expansion. While there is ongoing innovation and development in the field, the pace of product expansion is tempered by factors such as technological complexity, regulatory requirements, and the need for validation and standardization. Companies are introducing new protein chip platforms, assays, and applications to address emerging market needs and expand their product portfolios.

The market currently demonstrates a moderate level of regional expansion. Although there is increasing adoption of protein chip technology in various parts of the world, the expansion is influenced by factors such as regional healthcare infrastructure, research capabilities, regulatory environments, and market demand. Companies are strategically expanding their presence in key regions through partnerships, collaborations, and market entry initiatives.

Type Insights

Based on type, the analytical microarrays led the market with the largest revenue share of 54.86% in 2023, and is anticipated to grow at the fastest CAGR over the forecast period. This is attributed to the growing technological advancements. These platforms offer high-throughput capabilities, allowing for the simultaneous analysis of thousands of proteins in a single experiment. Continued advancements in microarray technology, such as improved sensitivity, resolution, and multiplexing capabilities, make them highly attractive for researchers and practitioners. For instance, in March 2023, Spectrum Solutions announced its acquisition of Alimetrix, Inc., a molecular diagnostic laboratory accredited by CLIA and CAP, specializing in tailored qualitative and quantitative assay development. In addition, they have acquired Microarrays, Inc., a renowned provider of array-based products utilized as biological research tools, including gene expression arrays and reverse and forward phase protein arrays.

The functional protein microarrays segment is expected to grow at a significant CAGR over the forecast period. Functional protein microarrays are valuable tools in drug discovery and development processes. They facilitate the screening of compound libraries for potential drug candidates, the identification of protein targets for drug intervention, and the assessment of drug specificity and efficacy. With the continuous need for novel therapeutics and the growing emphasis on personalized medicine, the demand for functional protein microarrays in drug discovery remains high.

Application Insights

Based on application, the antibody segment led the market with the largest revenue share of 56.52% in 2023. Antibody characterization is necessary for various biomedical research and clinical applications. It plays an important role in antibody-based therapeutics development, biomarker discovery, disease diagnosis, protein interaction studies, and immunodiagnostics. The versatility of antibody characterization applications across multiple domains makes it a cornerstone in the global market. For instance, in April 2023, Researchers from the KTH Royal Institute of Technology in Stockholm, Sweden, have engineered a microfluidic chip aimed at simplifying the monitoring of monoclonal antibody (mAb) production. This protein cartridge enables the concurrent analysis of up to four distinct proteins within cell cultures in a bioreactor.

The clinical diagnostics segment is expected to grow at the fastest CAGR over the forecast period. Protein chips are used in biomarker discovery for various diseases, including cancer, cardiovascular disorders, infectious diseases, autoimmune diseases, and neurological disorders. As the need for early disease detection, accurate diagnosis, and prognosis assessment rises, there is a growing demand for protein chip-based assays in clinical diagnostics. Moreover, in November 2023, Octave Bioscience, Inc. was awarded a USD 10 million grant from The Michael J. Fox Foundation to develop and validate a multi-analyte protein biomarker test for assessing Parkinson's disease.

End-use Insights

Based on end-use, the academic & research institutes segment led the market with the largest revenue share of 51.56% in 2023. Academic & research institutes conduct a wide range of research projects spanning basic science, translational research, and applied studies. Protein chip technology offers researchers a powerful tool for studying protein-protein interactions, biomarker discovery, drug screening, and disease mechanisms. For instance, in February 2024, a USD 1.97 million (£1.8 million) grant was secured by a team of academics from The University of Warwick and Aston University to produce membrane proteins, aiming to bolster sustainable manufacturing and aid in drug discovery. Therefore, academic and research institutes heavily utilize protein chips to advance their research objectives.

The diagnostic laboratories segment is expected to grow at the fastest CAGR during the forecast period. In diagnostic centers, protein chips are pivotal in revolutionizing healthcare delivery & enhancing diagnostic capabilities. These institutions utilize protein chips for a wide range of applications, enabling rapid and accurate diagnosis of diseases. Protein chips enable the detection of specific biomarkers or genetic variations associated with various conditions, aiding in the diagnosis of infectious diseases, genetic disorders, cancer, and other complex diseases. They offer high-throughput analysis, allowing for the screening of multiple samples simultaneously & facilitating timely patient management. For instance, in September 2023, CCM Biosciences launches CCM Protein Upregulation, targeting Alzheimer's, Parkinson's, infertility, and genetic diseases with advanced technology to enhance critical protein activity.

Regional Insights

North America dominated the protein chip market with a revenue share of 48.17% in 2023. The market is driven by factors such as presence of leading biotechnology and pharmaceutical companies, strong research and academic infrastructure, and early adoption of advanced technologies. Furthermore, significant resources to research and development (R&D) initiatives in the life sciences sector, including proteomics and biotechnology. For instance, in November 2023, March Biosciences, a US-based clinical-stage biotechnology company, has disclosed a USD 4.8 million investment from the Cancer Focus Fund for its Phase II clinical trial on MB-105, exploring its efficacy in relapsed T-cell leukemias and lymphomas. MB-105, a chimeric antigen receptor-T cell (CAR-T) therapy, specifically targets CD5, a protein commonly found in both normal and malignant T-cells.

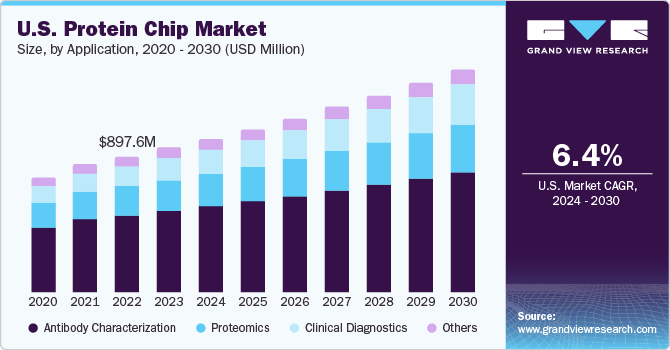

U.S. Protein Chip Market Trends

The protein chip market in the U.S. is expected to grow at the fastest CAGR over the forecast period, due to presence of a large number of market players in U.S. which are undergoing various strategic initiatives such as collaborations and partnerships.

Europe Protein Chip Market Trends

The protein chip market in Europe was identified as a lucrative region in this industry. This can be attributed to strong biotechnology & pharmaceutical sectors. Several biotechnology & pharmaceutical companies are getting established, and rising startups, and many research institutions collaborating are anticipating boosting the market growth.

The UK protein chip market is expected to grow at the fastest CAGR over the forecast period. Goodhealthcare infrastructure & accessibility, growing investment in precision medicine initiatives, and rising preference for chronic disorders are anticipated to drive market growth in the UK.

The protein chip market in France is expected to grow at the fastest CAGR over the forecast period, due to increasing awareness of technological advancements and its adoption in various research activities.

The Germany protein chip market is expected to grow at the fastest CAGR over the forecast period, due to presence of a substantial number of local providers of biotechnology and pharmaceutical tools.

Asia Pacific Protein Chip Market Trends

The protein chip market in Asia Pacific is anticipated to grow at the fastest CAGR of 8.49% over the forecast period. The region is experiencing significant growth in the biotechnology and pharmaceutical sectors, driven by factors such as increasing healthcare expenditure, rising prevalence of chronic diseases, and expanding research and development activities. As biotechnology and pharmaceutical companies in the region seek to enhance drug discovery, personalized medicine, and diagnostics capabilities, there is a growing demand for advanced technologies like protein chips.

The China protein chip market is expected to grow at the fastest CAGR over the forecast period. This is attributed to rising geriatric population and growing population which is anticipated to increase the demand for various drug thereby boosting the market growth.

The protein chip market in Japan is expected to grow at the fastest CAGR over the forecast period. The primary factors such as presence of several pharmaceutical & biotechnology companies, rising health consciousness, and growing demand for preventive healthcare are anticipated to boost the demand for the protein chip for various research and clinical purposes.

The India protein chip market is expected to grow at the fastest CAGR over the forecast period, due to its large population and increasing focus on healthcare infrastructure and growing prevalence of chronic diseases such as cancer.

Middle East & Africa Protein Chip Market Trends

The protein chip market in the Middle East & Africa is expected to grow at the exponential CAGR over the forecast period, due to several key factors. These include increasing investments in healthcare infrastructure and research, rising prevalence of chronic diseases, growing adoption of advanced diagnostic technologies, government initiatives to improve healthcare standards, and expanding collaborations with international partners and companies.

The Saudi Arabia protein chip market is expected to grow at the fastest CAGR during the forecast period, owing to the growing collaborations among research & academic institutes for biotechnology related research is anticipated to boost the market growth.

The protein chip market in Kuwait is expected to grow at the fastest CAGR over the forecast period. Kuwait has been increasing its healthcare expenditure to improve healthcare infrastructure, services, and technology adoption is anticipated to boost the market growth.

Key Protein Chip Company Insights

The market players operating in the global market are adopting product approval to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Protein Chip Companies:

The following are the leading companies in the protein chip market. These companies collectively hold the largest market share and dictate industry trends.

- Agilent Technologies, Inc.

- PerkinElmer

- Bio-Rad Laboratories

- Thermo Fisher Scientific Inc.

- Sigma-Aldrich Corporation

- Illumina, Inc.

- Shimadzu Corporation

- Roche Diagnostics

- RayBiotch

- Danaher

Recent Developments

-

In January 2024, Agilent Technologies announced the launch of ProteoAnalyzer system, an innovative automated parallel capillary electrophoresis system designed for protein analysis. This new platform enhances efficiency and simplifies the analysis of intricate protein mixtures, a crucial step in analytical workflows spanning the pharmaceutical, biotechnology, food analysis, and academic sectors

-

In December 2023, Theralink Technologies announced groundbreaking research conducted by George Mason University and the University of California, San Francisco. This collaboration, stemming from the ISPY-2 trial, evaluated tumors from over 700 breast cancer patients using RPPA, revealing novel therapeutic avenues for some of the most daunting breast cancers that elude detection by existing diagnostic methods

-

In September 2023, Yamaha Motor Co., Ltd. established Tuning Fork Bio Inc. in Delaware, USA, to analyze antibodies in blood for health visualization. Mainly targeting the U.S. and Japan, the company's antibody profiling aids in health checkups, drug selection, and pharmaceutical research

Protin Chip Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.25 billion

Revenue forecast in 2030

USD 3.36 billion

Growth rate

CAGR of 6.88% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Agilent Technologies; PerkinElmer; Bio-Rad Laboratories; Thermo Fisher Scientific; Sigma-Aldrich Corporation; Illumina; Shimadzu Corporation; Roche Diagnostics; RayBiotech; Danaher

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Protein Chip Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the protein chip market report based on type, application, end use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Analytical Microarrays

-

Functional Protein Microarrays

-

Reverse Phase Protein Microarrays

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Antibody Characterization

-

Clinical Diagnostics

-

Proteomics

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals & Clinics

-

Diagnostic Laboratories

-

Academic & Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the protein chip market Agilent Technologies; PerkinElmer; Bio-Rad Laboratories; Thermo Fisher Scientific; Sigma-Aldrich Corporation; Illumina; Shimadzu Corporation; Roche Diagnostics; RayBiotech; and Danaher.

b. The protein chip market has generated significant growth in recent years owing to growing prevalence of chronic diseases such as cancer, cardiovascular diseases, and neurological disorders, increasing diagnostic applications, and Ongoing technological advancements.

b. The global protein chip market size was estimated at USD 2.12 billion in 2023 and is expected to reach USD 2.25 billion in 2024.

b. The global protein chip market is expected to grow at a compound annual growth rate of 6.88% from 2024 to 2030 to reach USD 3.36 billion by 2030.

b. North America has accounted for the largest revenue share of 48.17% in 2023 for the protein chip market. The market is driven by factors such as presence of leading biotechnology and pharmaceutical companies, strong research and academic infrastructure, and early adoption of advanced technologies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."